Ready to take the next step? Get in touch with us today to discuss your legal needs and explore how we can assist you in achieving your business objectives. Our dedicated team is here to provide you with personalized attention and experienced guidance every step of the way. With our legal counsel, you can take the necessary steps to enter one of the most important growing economies in the world.

In Need Of Legal Advice?

Schedule A ConsultationKhalaf Bandar | International Advisors PLLC’s Operation

We are based in Riyadh, Saudi Arabia, and this has only helped us connect and support businesses around the country and abroad. Our legal experience includes working relationships with businesses based in countries such as:

- The United States

- Europe

- Bahrain

- Kuwait

- Oman

- Qatar

- The United Arab Emirates

- And many more

Domestic vs. International Business Law

In Saudi Arabia, foreign and local business laws differ mainly in ownership and origin rules. These rules affect how businesses operate in the country. Here are some key differences:

Ownership and Investment

- Domestic Business Law: Primarily governs businesses that are fully owned by Saudi nationals. These businesses often have fewer restrictions and may benefit from certain government incentives.

- Foreign Business Law: Applies to businesses with foreign ownership. Foreign investors must follow rules from the Saudi Arabian General Investment Authority (SAGIA). This includes getting the right licenses and following foreign ownership limits in some sectors. Our Saudi Arabian attorney understands this well.

Licensing and Permits

- Domestic Businesses generally face a more straightforward process for obtaining licenses and permits.

- Foreign businesses must navigate additional layers of bureaucracy and meet specific criteria to obtain investment licenses, especially in sectors that restrict foreign ownership.

Taxation

- Domestic Businesses are typically subject to zakat, a form of Islamic tax.

- Foreign businesses must pay corporate income tax on their profits. This tax can be different from the zakat system used for local companies.

Legal and Regulatory Compliance

- Domestic Businesses must follow local commercial laws and regulations, which may be more lenient in certain aspects.

- Foreign Businesses must comply with both local laws and additional regulations aimed at foreign entities. This can include restrictions on the repatriation of profits and requirements for local partnerships in certain industries.

Sector-Specific Restrictions

Certain sectors may be closed or have limited access to foreign investors, while domestic businesses may operate more freely within these sectors.

Services Offered by the Riyadh Attorney at Khalaf Bandar | International Advisors PLLC

At Khalaf Bandar | International Advisors PLLC, our international and domestic business law experience spans several critical areas essential for business success:

Legal Advice

Our seasoned Riyadh attorney provides comprehensive legal consultations to help businesses navigate Saudi commercial laws.

Contract Drafting

We are experienced in drafting and reviewing contracts to secure your business’s special interests, ensuring clarity and legality in all agreements.

Litigation

Our litigation team has experience in representing clients in disputes. We will leverage our experience to achieve the most favorable outcome possible.

Alternative Dispute Services

We offer alternative dispute services that include arbitration, mediation, and consensual settlement. This provides cost-effective and efficient alternative dispute options to avoid more time-consuming and costly traditional litigation for resolving business disputes.

Domestic & Foreign Business Law

Our Saudi Arabian attorney will guide you through the intricacies of Saudi business law. This includes everything from company formation to regulatory compliance, ensuring your business stands on solid legal ground.

Joint Stock Company Services

Our firm offers services for the formation and management of joint stock companies in Saudi Arabia, helping you benefit from this corporate structure’s benefits.

Contracts and Agreements

From joint ventures to employment contracts, our team ensures your agreements are comprehensive and airtight. Our Riyadh attorney is here to protect you and your business assets.

Real Estate Construction

Our experience includes real estate and construction law, ensuring your projects comply with local regulations and industry standards. It’s important to have a Riyadh attorney who understands real estate law around the capital.

Social Insurance

We help domestic and foreign businesses understand their social insurance obligations. This will ensure compliance with domestic business law and effective management of employee benefits.

Khalaf Bandar | International Advisors PLLC is Here to Support Domestic and International Business in Saudi Arabia

Khalaf Bandar | International Advisors PLLC can be your partner for navigating the intricate legal landscape of Saudi Arabia. Our deep understanding of domestic and international business laws, combined with our strategic networks, positions us to support your business endeavors.

Whether you’re a local entrepreneur seeking to expand your operations or an international business owner exploring opportunities in Saudi Arabia, we are here to provide the legal advice and guidance you need to succeed.

Reach out to Khalaf Bandar | International Advisors PLLC today to discover how we can help your business thrive in Saudi Arabia. Contact us via email or phone to schedule a consultation and take the first step toward a successful business journey.

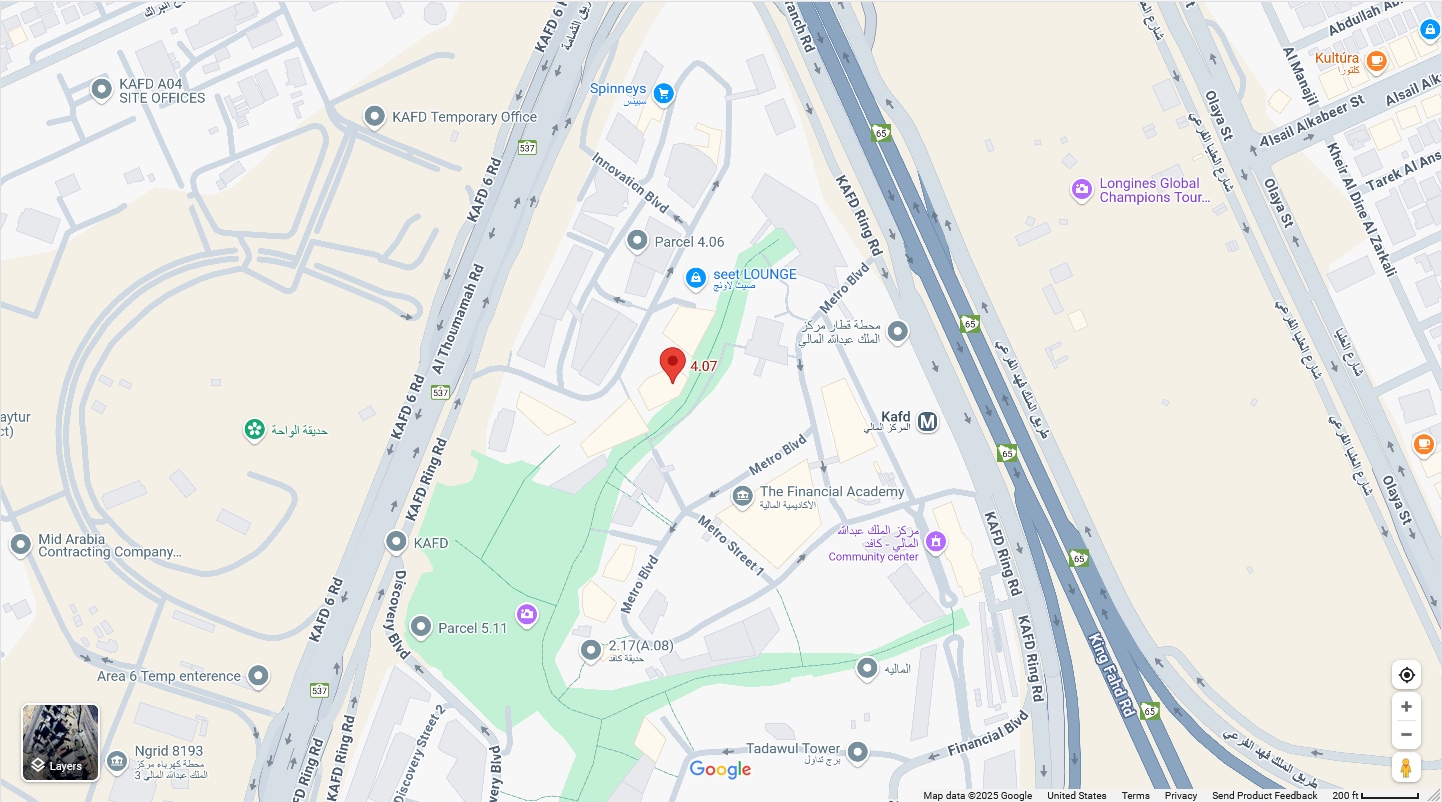

Schedule an appointment at our office:

Building 4.07, Floor 7, Innovation Blvd, KAFD, Riyadh, Saudi Arabia, 13519

Khalaf Bandar | International Advisors PLLC is Here to Support Domestic and International Business in Saudi Arabia

Khalaf Bandar | International Advisors PLLC can be your partner for navigating the intricate legal landscape of Saudi Arabia. Our deep understanding of local and international business laws, combined with our strategic networks, positions us to support your business endeavors.

Whether you’re a local entrepreneur seeking to expand your operations or an international business owner exploring opportunities in Saudi Arabia, we are here to provide the legal advice and guidance you need to succeed.

Reach out to Khalaf Bandar | International Advisors PLLC today to discover how we can help your business thrive in Saudi Arabia. Contact us via email or phone to schedule a consultation and take the first step toward a successful business journey.